More About Custom Private Equity Asset Managers

(PE): investing in firms that are not publicly traded. Approximately $11 (https://folkd.com/link/Custom-Private-Equity-Asset-Managers). There may be a couple of points you do not understand regarding the market.

Personal equity companies have a range of financial investment choices.

Since the most effective gravitate toward the bigger deals, the center market is a considerably underserved market. There are a lot more sellers than there are highly seasoned and well-positioned financing experts with substantial customer networks and sources to manage a deal. The returns of personal equity are normally seen after a couple of years.

Examine This Report on Custom Private Equity Asset Managers

Traveling listed below the radar of huge international companies, much of these small business commonly supply higher-quality customer care and/or niche products and services that are not being supplied by the huge empires (https://www.mixcloud.com/cpequityamtx/). Such benefits draw in the passion of personal equity firms, as they have the insights and wise to manipulate such possibilities and take the business to the next degree

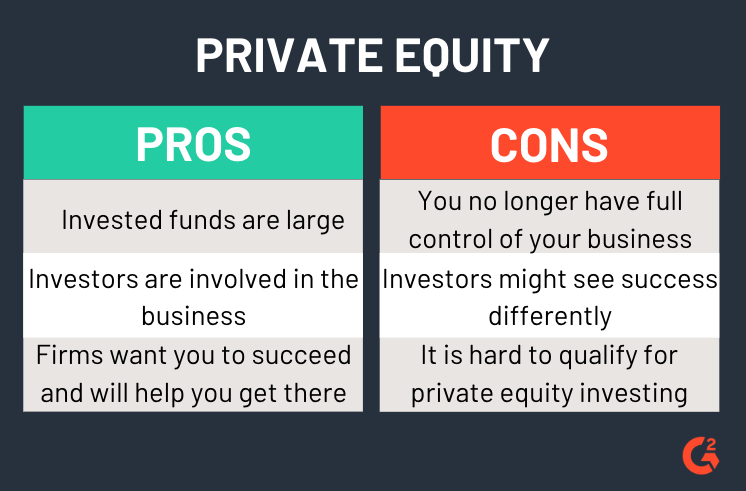

Exclusive equity investors have to have reliable, qualified, and reputable administration in place. The majority of supervisors at profile business are provided equity and incentive compensation structures that compensate them for hitting their monetary targets. Such alignment of goals is commonly required prior to an offer gets done. Exclusive equity opportunities are usually unreachable for people who can not invest millions of bucks, however they should not be.

There are policies, such as limitations on the aggregate quantity of money and on the number of non-accredited investors. The exclusive equity service brings in several of the most effective and brightest in corporate America, consisting of top performers from Fortune 500 firms read this article and elite monitoring consulting companies. Law office can also be hiring grounds for personal equity employs, as accountancy and legal skills are essential to complete bargains, and transactions are highly demanded. https://cpequityamtx.carrd.co/.

Custom Private Equity Asset Managers Can Be Fun For Anyone

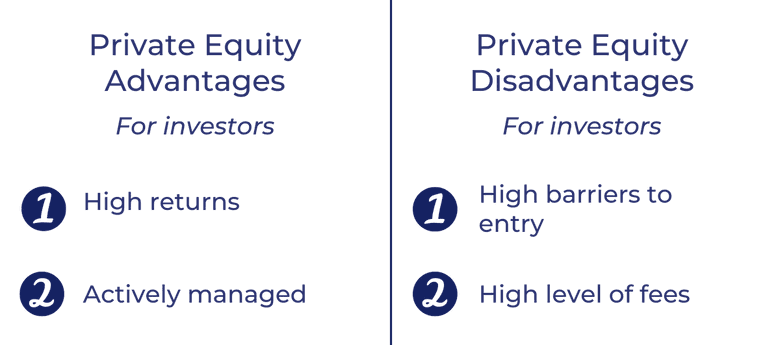

Another drawback is the absence of liquidity; as soon as in a private equity deal, it is challenging to leave or sell. There is a lack of flexibility. Exclusive equity also features high fees. With funds under management currently in the trillions, exclusive equity firms have ended up being attractive financial investment automobiles for rich people and establishments.

Currently that accessibility to personal equity is opening up to even more private financiers, the untapped potential is becoming a reality. We'll begin with the major arguments for investing in personal equity: Just how and why private equity returns have actually traditionally been higher than other assets on a number of degrees, Just how including personal equity in a profile influences the risk-return account, by assisting to branch out versus market and cyclical risk, After that, we will detail some crucial considerations and dangers for exclusive equity investors.

When it concerns introducing a new asset right into a portfolio, the a lot of standard consideration is the risk-return account of that possession. Historically, personal equity has displayed returns similar to that of Emerging Market Equities and higher than all other typical asset courses. Its reasonably reduced volatility coupled with its high returns produces a compelling risk-return profile.

The smart Trick of Custom Private Equity Asset Managers That Nobody is Talking About

Personal equity fund quartiles have the widest variety of returns throughout all alternate property classes - as you can see below. Method: Inner rate of return (IRR) spreads out computed for funds within vintage years individually and after that balanced out. Mean IRR was computed bytaking the standard of the typical IRR for funds within each vintage year.

The takeaway is that fund selection is critical. At Moonfare, we perform a rigorous choice and due diligence procedure for all funds noted on the platform. The impact of adding exclusive equity into a profile is - as always - depending on the profile itself. A Pantheon research from 2015 suggested that consisting of private equity in a portfolio of pure public equity can open 3.

On the other hand, the most effective private equity companies have accessibility to an also bigger pool of unidentified chances that do not face the very same examination, in addition to the sources to carry out due persistance on them and recognize which deserve purchasing (Private Equity Firm in Texas). Investing at the very beginning suggests greater threat, however for the companies that do be successful, the fund gain from higher returns

Custom Private Equity Asset Managers Fundamentals Explained

Both public and private equity fund managers dedicate to investing a percent of the fund however there remains a well-trodden concern with aligning rate of interests for public equity fund administration: the 'principal-agent problem'. When a capitalist (the 'principal') works with a public fund manager to take control of their resources (as an 'agent') they pass on control to the supervisor while retaining ownership of the possessions.

In the case of private equity, the General Partner doesn't just earn a monitoring charge. Private equity funds likewise reduce an additional kind of principal-agent issue.

A public equity capitalist inevitably desires one point - for the administration to enhance the stock price and/or pay dividends. The capitalist has little to no control over the choice. We showed above the number of private equity methods - especially majority buyouts - take control of the running of the business, making certain that the long-term value of the business comes first, pushing up the roi over the life of the fund.